CSRD : the real voice to the European Businesses

Plus de 1 000 entreprises partout en Europe ont complété la plus grande enquête sur ce qu'attendent vraiment les entreprises de l'omnibus et de la CSRD. Etude réalisée en partenariat avec HEC Paris pa We are Europe.

The survey results change the overall perceived narrative on the CSRD

Response rate obtained across all European countries suggests a strong interest and engagement of business leaders involved in the implementation of CSRD. Notably,40% hold C-level positions, highlighting the strategic importance the CSRD has gained within companies, and 26% of

Response rate obtained across all European countries suggests a strong interest and engagement of business leaders involved in the implementation of CSRD. Notably,40% hold C-level positions, highlighting the strategic importance the CSRD has gained within companies, and 26% of

respondents expressed a willingness to participate in further qualitative research.

Our various sensitivity tests using breakdowns by regions, sectors, company size and with non sustainibility professionals confirm the robustness

of overall results.

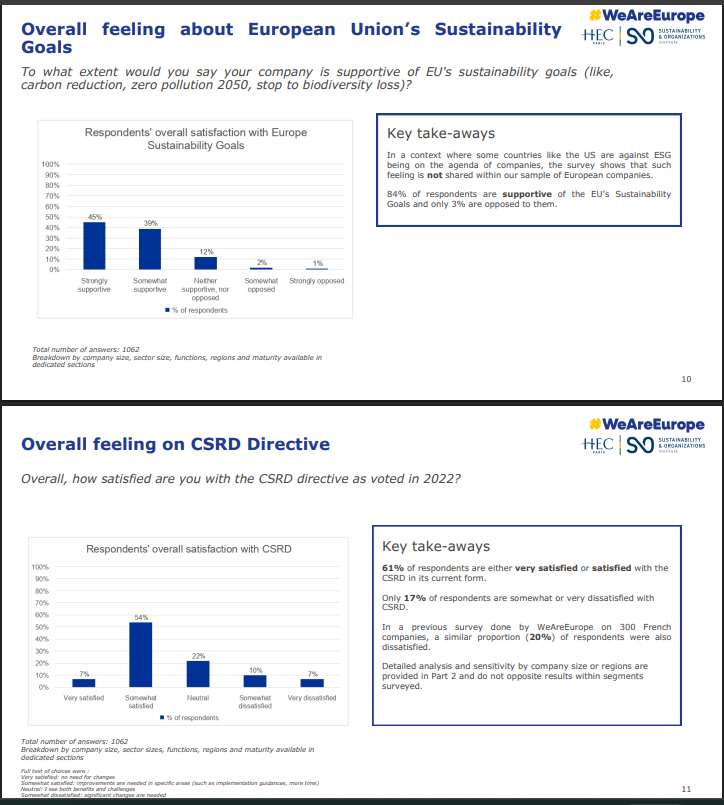

With respondents spread across countries, sectors, company size, and maturity levels, overall only 17% of respondents expressed dissatisfaction

with the CSRD, out of which 10% call for targeted improvements and 7% believe a fundamental revision or replacement is necessary. Even among

finance professional respondents, typically considered more cautious, only 27% expressed dissatisfaction, compared to just 14% among CSR functions.

In contrast, feedback on the “Omnibus” proposal is significantly more negative: only 25% of respondents support the Omnibus proposal as it

stands while 51% believe major changes are required during the legislative process.

The key identified strengths of the CSRD include its ability to ensure transparency and comparability in ESG reporting and more importantly to serve as a

strategic management tool for steering business transformation.

A striking new narrative also emerges: the CSRD is widely seen as a potential geopolitical asset for Europe. 90% of respondents endorsed its relevance

across the three surveyed dimensions of sovereignty and economic influence—a rarely discussed yet powerful argument for European leadership.

While the main criticisms of CSRD include insufficient technical guidance, a lack of proportionality for smaller companies, and the costly and timeconsuming nature of implementation, the concern that the CSRD puts EU companies at a competitive disadvantage was the least cited of the six

potential barriers presented—challenging a commonly heard argument. The 1000 employees treshold as an alternative to 250 is rejected by the majority

and a 500 treshold prefered even among companies between 500 to 1000 employees.

Regional contrasts also emerged: Eastern European respondents show the highest levels of concern and challenge with CSRD, whereas Nordic and

Western countries as well as France show strong overall support. Germany's support level (with 21% dissatisfied) is relatively close to France’s (16%),

which contrasts sharply with recent political narratives reported in Germany that German companies are not ready or willing to embrace ESG reporting.

Finally, support for the CSRD increases with firm size: from 57% support among companies with 250–500 employees, to 67% among those with over

5,000 employees.